Way to go, people. After bailing out Fannie, Freddie, Lehman, and AIG, you developed such a taste for it. Now, to quench your thirst, you've decided to go ahead and buy up all the bad debt in the country. Whether the bad debt is because of national or international interests, we are buying it all up in the biggest move since the Great Depression. It really doesn't matter, though. The morons who got us in this mess (stupid people who don't live within their means, corrupt CEOs, high-risk lenders, and idiot bureaucrats) probably won't learn their lesson as a result of this. The interesting thing about this is how it affects the election. We will talk about McCain and Obama's stance on this later, but I love how everyone is playing the blame game. They are blaming:

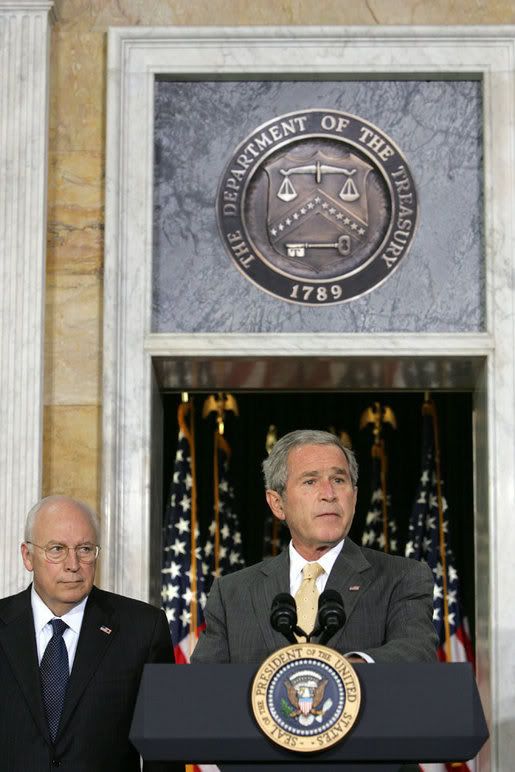

- George Bush and his administration: Well, George Bush has repeatedly called for more regulation against the mortgage giants that went under. In fact, this year alone, he publicly called for reform on Freddie and Fannie 17 times. SEVENTEEN TIMES THIS YEAR! The Democratic Congress ignored his warnings, ignored the problems, and buried his concerns in legislative gobblety-gook. It doesn't absolve GW, but clearly he did his part.

- Bill Clinton and his administration: Former Fannie Mae chairman Franklin Raines was the White House budget director under Clinton. Raines is also an economic advisor to Obama, but why would anyone take advice from a douchebag who ran his company into the ground?

- John McCain and his staff: McCain advisors have been cited as lobbyists to shady mortgage lending firms. Plus, McCain has been in Washington forever and hasn't done anything to help the situation.

- Barack Obama and his staff: Obama, in his short time in the Senate, has received the second largest amount in campaign contributions from Fannie Mae. Also, Obama appointed Jim Johnson as one three men to lead his VP search. Too bad Jim Johnson was a former bigwig at Fannie Mae AND Lehman Bros. He had to drop out of the VP search committee once people found out of his corrupt dealings with Countrywide, yet another dirty player in the housing scandal. For two people that are promising change and reform, Obama and McCain continue to surround themselves with the same shady roster of players.

So, you keep hearing about this housing/credit crisis, but you don't know how we reached this slippery slope? I'll break it down for you real easy. Moron lenders gaving housing loans to idiot people who knew they couldn't afford them. These idiot people default on their mortgages, so we have thousands of idiots not paying money back to creditors. The creditors are forced to eat these bad loans, but they lose so much money they are forced to fold. Insurance companies like AIG who have hundreds of millions of dollars tied into these mortgage companies also lose their money and suddenly they are out of business. Now investors are afraid of banking on the U.S. Banks can't give out loans for cars or homes anymore. Businesses who rely on loans to expand and grow can no longer get them, and they are forced to cut back. Average Joe Idiot is out of a job because businesses are cutting back, and now Average Joe Idiot has to cut back on his spending. Because Average Joe Idiot is cutting back on spending, this only hurts Mr. Businessman even more, and the cycle continues until we hit another Depression. That's why Dubya had to do the bailout. We, as taxpayers, must save the idiots, but also the rest of the country.

So, you keep hearing about this housing/credit crisis, but you don't know how we reached this slippery slope? I'll break it down for you real easy. Moron lenders gaving housing loans to idiot people who knew they couldn't afford them. These idiot people default on their mortgages, so we have thousands of idiots not paying money back to creditors. The creditors are forced to eat these bad loans, but they lose so much money they are forced to fold. Insurance companies like AIG who have hundreds of millions of dollars tied into these mortgage companies also lose their money and suddenly they are out of business. Now investors are afraid of banking on the U.S. Banks can't give out loans for cars or homes anymore. Businesses who rely on loans to expand and grow can no longer get them, and they are forced to cut back. Average Joe Idiot is out of a job because businesses are cutting back, and now Average Joe Idiot has to cut back on his spending. Because Average Joe Idiot is cutting back on spending, this only hurts Mr. Businessman even more, and the cycle continues until we hit another Depression. That's why Dubya had to do the bailout. We, as taxpayers, must save the idiots, but also the rest of the country.

No comments:

Post a Comment